You also should have taken time to think about your tax situation, your pension levels and timeline, your personal views on risk and security depending on your personal and family situations, and how much you can afford to invest and where.

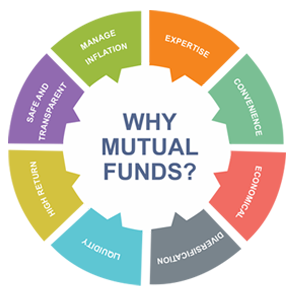

So first you need to know if and how much you can invest whether in monthly deposits, lump sums or deductions from paychecks. The beginning place for most people to invest is Stock Funds. They have the highest growth potential with dividend income also. They are the riskiest type and with risk comes return (profit or dividends) and are ideal for younger people to start with. People with larger incomes and less worry about risk compared to earning more income may also benefit. There are Blended Funds which mix Growth and Value companies to minimize risk as you get older or want to broaden your portfolio as it grows. Then Value Funds which grow steadier and have dividends to conserve your investment with less risk from Blue Chip companies. And finally Balanced Funds which mix Stocks and Bonds to give even more shelter from risk (and possible loss) at the cost of growth with interest income from bonds which is steady and more predictable.

The other side of Mutual Funds is Bond Funds which are more stable than stocks and react opposite to the market than Stock Funds do. They provide income from interest and also come in a variety of types. They can be Corporate or Municipal which are taxable vs tax-free, and pay different levels of interest based on risk and taxability. Tax-free bonds pay less interest since you won’t pay income tax on the interest and the risk is lower. These are where your account will move to as you age and want less risk and volatility but still want income and security.

So to recap general advice of Mutual fund investing, these are guidelines you should use to make and manage your investments: The younger you are the more risk you should tolerate and take for future growth since you won’t need the money for a long time and letting it reinvest and compound will give very good returns. Next, as you have more money to invest you should widen your choices in different types of Stock Funds to lower risk and get more opportunities for growth from various areas such as different size companies, international companies and new technology areas in old and new companies.

From there you should invest in Blended Funds which mix Growth and Value style companies to secure a piece of your portfolio with stability. Again as you age or your personal situations change with family needs and hopeful income growth you can expand the mix of funds. These guidelines apply in and out of IRAs (both types) and also any job pension opportunities. The last move to Bond Funds would come around the time you retire or plan to, depending again on the stock market and your personal situations of financial needs. Next article will be more specific about investing limits and places for your investments.

Please meet with a licensed financial advisor to determine the best course of action for you as an individual.