If you’re preparing to file your federal, state and local tax returns, remember these tips and stop fraud in its tracks.

Mailbox fishing is the process by which thieves gain entry to the interiors of mailboxes and steal mail. The purpose of stealing the mail is to obtain checks, credit/debit/gift cards and other personally identifiable information that would allow the thief and others to gain access to your finances. If you’re mailing checks, money orders, or tax returns, protect yourself from mailbox fishing and check fraud:

• Drop mail containing checks inside the post office to ensure that your mail is not stolen from a mailbox.

• When writing checks, use permanent ink that cannot be erased.

• Check your account balance frequently to ensure that the proper amount is debited and that your check was cashed by the intended payee.

• If you see anyone tampering with a mailbox, report it immediately to 911.

If you’re filing through a tax professional

• Make sure they have an IRS Preparer Tax Identification (PTIN) or are members of a professional organization.

• Confirm all service fees upfront.

If you are filing online

• Use a secure connection. Change your home Wi Fi name and password from the default.

• Beware of fake websites or emails that may attempt to steal your personal information.

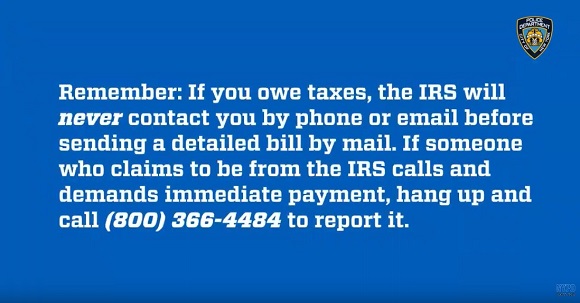

• Remember, if you owe taxes, the IRS will never contact you by phone or email before sending a detailed bill by mail. If someone who claims to be from the IRS calls and demands immediate payment, hang up and call (800) 366-4484 to report it.

Tax season is painful enough – protect yourself from fraud!